The financial industry has undergone significant changes in recent years, with the emergence of new technologies and changing consumer preferences. One of the most notable developments in this sector is the rise of financial technology, or fintech, companies. These innovative firms are disrupting traditional banking and financial services by offering more efficient, user-friendly, and often more affordable solutions.

Fintech companies are leveraging cutting-edge technologies, such as artificial intelligence, blockchain, and mobile applications, to provide a wide range of services. From digital banking and online lending to wealth management and payment processing, these companies are meeting the evolving needs of consumers and businesses alike. By harnessing the power of technology, fintech firms are able to offer more personalized, streamlined, and accessible financial services, often at a lower cost.

One of the key advantages of fintech is its ability to cater to the preferences of younger generations, who have grown up in the digital age and expect seamless, on-demand financial services. Fintech companies have been successful in attracting these tech-savvy consumers by providing intuitive mobile apps, easy-to-use platforms, and personalized financial solutions.

Moreover, fintech is not just disrupting the consumer market; it is also transforming the way businesses operate. Small and medium-sized enterprises (SMEs), in particular, have benefited from the innovations brought forth by fintech. These companies can now access financing, manage their finances, and streamline their operations more efficiently through fintech solutions, leveling the playing field with larger corporations.

However, the rise of fintech has also raised concerns about security, data privacy, and financial regulation. As these companies handle sensitive financial information and transactions, they must ensure robust security measures and comply with evolving regulatory frameworks. Collaboration between fintech firms and traditional financial institutions, as well as with regulatory bodies, will be crucial in addressing these challenges and fostering a stable and secure financial ecosystem.

Despite these challenges, the fintech industry continues to grow rapidly, with investment and funding pouring in from venture capitalists and other investors. The ongoing evolution of fintech is expected to transform the financial landscape, leading to increased competition, innovation, and better service for consumers and businesses alike.

In conclusion, the fintech revolution is reshaping the financial industry, providing more efficient, user-friendly, and affordable financial solutions. As technology continues to advance, the fintech sector will undoubtedly play a pivotal role in shaping the future of finance, creating new opportunities and challenges for traditional financial institutions, regulators, and consumers.

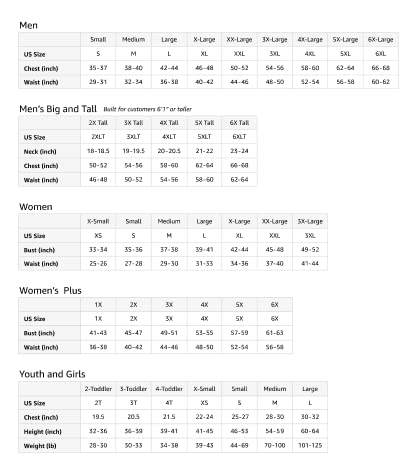

product information:

| Attribute | Value |

|---|